Tenneco Reports First Quarter 2017 Results

- Record-high first quarter revenue, outpacing industry production

- Record-high EBIT, net income and EPS

- Improved cash flow from operations

Lake Forest, Illinois, May 1, 2017 – Tenneco Inc. (NYSE: TEN) reported record first quarter net income of $63 million, or $1.16 per diluted share, compared with $57 million, or 99-cents per diluted share in first quarter 2016. Adjusted net income increased 24% to a first quarter record high of $83 million, compared with $67 million last year. First quarter adjusted earnings per share also rose to a new record high of $1.53 per diluted share, a 31% improvement year-over-year.

Revenue

Total revenue in the first quarter was $2.292 billion, up 7% year-over-year, driven by higher revenue in both the Clean Air and Ride Performance product lines.

On a constant currency basis, total first quarter revenue increased 9% to $2.329 billion, outpacing industry production growth of 6%.* Record revenue in the quarter reflects an 11% increase in light vehicle revenue on the strength of the company’s global platform position. Commercial truck revenue increased 15%, outpacing industry growth of 5%. Off-highway revenue was about even with last year on continuing weak industry production. Global aftermarket revenue was also about even with a year ago.

In constant currency, value-add revenue increased 9% versus last year, and included 10% growth in Clean Air revenues, and 7% higher Ride Performance revenue.

“We started the year strong by delivering another record quarter with our highest-ever first quarter revenue, EBIT, net income and earnings per share,” said Gregg Sherrill, chairman and CEO Tenneco. “The strong balance across our business in terms of regions, end-markets, customers and products helped us deliver another quarter of profitable growth as we executed well on growth plans for each product line.”

Adjusted first quarter 2017 and 2016 results

| Q1 2017 | Q1 2016 | |||||||||||||||||

| (millions except per share amounts) | EBITDA* | EBIT | Net income attributable to Tenneco Inc. | Per Share | EBITDA* | EBIT | Net income attributable to Tenneco Inc. | Per Share | ||||||||||

| Earnings Measures | $ | 179 | $ | 127 | $ | 63 | $ | 1.16 | $ | 178 | $ | 124 | $ | 57 | $ | 0.99 | ||

| Adjustments (reflects non-GAAP measures): | ||||||||||||||||||

| Restructuring and related expenses | 14 | 15 | 14 | 0.25 | 11 | 14 | 13 | 0.23 | ||||||||||

| Pension Charges/stock vesting | 11 | 11 | 7 | 0.13 | - | - | - | - | ||||||||||

| Net tax adjustments | - | - | (1) | (0.01) | - | - | (3) | (0.05) | ||||||||||

| Non-GAAP earnings measures | $ | 204 | $ | 153 | $ | 83 | $ | 1.53 | $ | 189 | $ | 138 | $ | 67 | $ | 1.17 | ||

EBIT and EBIT Margin

First quarter EBIT (earnings before interest, taxes and noncontrolling interests) increased to $127 million, versus $124 million last year, and adjusted EBIT rose 11% to $153 million, both record highs for the first quarter.

Tenneco EBIT as a percent of revenue was 5.5% due to higher restructuring and other charges in the quarter. Adjusted EBIT as a percent of value-add revenue improved 30 basis points to 8.8%.

EBIT was driven by leveraging strong light vehicle volumes, strong commercial truck growth and continuing operational efficiencies. The year-over year comparison includes $4 million in negative currency.

First quarter EBIT margin

|

|

Q1 2017 | Q1 2016 | ||

| EBIT as a percent of revenue | 5.5% | 5.8% | ||

| EBIT as a percent of value-add revenue | 7.3% | 7.6% | ||

| Adjusted EBIT as a percent of revenue | 6.7% | 6.5% | ||

| Adjusted EBIT as a percent of value-add revenue | 8.8% | 8.5% | ||

Cash

Cash used by operations in the quarter was $9 million, compared with a cash use of $29 million a year ago, driven by higher earnings and continued strong performance in accounts receivables, payables and inventories.

During the quarter, Tenneco repurchased 240,000 shares of common stock for $16 million. Since January 1, 2015, the company has repurchased a total of 8.7 million shares of common stock for $454 million.

In the first quarter, the company also paid a dividend of 25-cents per share, or $13 million.

OUTLOOK

Second quarter 2017

In the second quarter, Tenneco expects year-over-year revenue growth of approximately 5% on a constant currency basis, outpacing estimated light vehicle industry production growth* by four percentage points. Based on current exchange rates, the company anticipates approximately 2% currency headwind in the second quarter.

The company’s organic revenue growth is expected to be driven by Clean Air and Ride Performance content on top-selling light vehicle platforms globally; continued strong commercial truck growth; and a steady contribution from the global aftermarket.

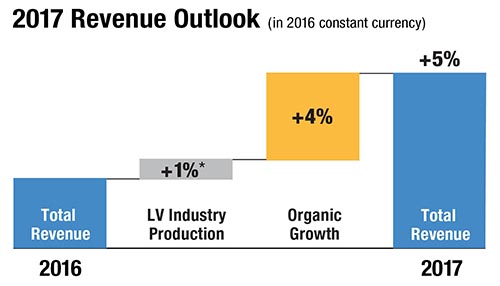

Full Year 2017

Tenneco also reaffirms its full-year revenue growth outlook announced in January. On a constant currency basis, the company expects year-over-year revenue growth of 5%, outpacing estimated light vehicle industry growth by 4 percentage points. The company also expects annual margin improvement in 2017.

Image

“Tenneco continues to have outstanding growth opportunities, supported by sustainable drivers and a technology portfolio aligned with positive market trends globally,” said Sherrill. “With distinct growth strategies for each product line, and our continuous improvement culture, we are making strong progress on our growth objectives and executing well to further drive higher earnings and improve profitability.”

*Source: IHS Automotive April 2017 global light vehicle production forecast and Tenneco estimates.

Click here to download Q1 2017 release including all attachments listed below

Attachment 1

Statements of Income – 3 Months

Balance Sheets

Statements of Cash Flows – 3 Months

Attachment 2

Reconciliation of GAAP Net Income to EBITDA including noncontrolling interests – 3 Months

Reconciliation of GAAP to Non-GAAP Earnings Measures – 3 Months

Reconciliation of GAAP Revenue to Non-GAAP Revenue Measures – 3 Months

Reconciliation of GAAP Revenue to Non-GAAP Revenue Measures – 3 Months

Reconciliation of Non-GAAP Measures – Debt Net of Cash/Adjusted LTM EBITDA including noncontrolling interests

Reconciliation of GAAP Revenue to Non-GAAP Revenue Measures – Original Equipment and Aftermarket Revenue – 3 Months

Reconciliation of GAAP Revenue and Earnings to Non-GAAP Revenue and Earnings Measures – 3 Months

Reconciliation of GAAP Revenue to Non-GAAP Revenue Measures – Original Equipment Commercial Truck, Off-Highway and other revenues – 3 Months

CONFERENCE CALL

The company will host a conference call on Monday, May 1, 2017 at 10:00 a.m. ET. The dial-in number is 888-989-6519 (domestic) or 630-395-0180 (international). The passcode is TENNECO. The call and accompanying slides will be available on the financial section of the Tenneco web site at www.investors.tenneco.com. A recording of the call will be available one hour following completion of the call on May 1, 2017 through June 1, 2017. To access this recording, dial 800-937-4851 (domestic) or 203-369-3401 (international). The purpose of the call is to discuss the company’s operations for the first fiscal quarter of 2017, as well as provide updated information regarding matters impacting the company’s outlook. A copy of the press release is available on the financial and news sections of the Tenneco web site.

ANNUAL MEETING

The Tenneco Board of Directors has scheduled the corporation’s annual meeting of shareholders for Wednesday, May 17, 2017 at 10:00 a.m. CT. The meeting will be held at the corporate headquarters, 500 North Field Drive, Lake Forest, Illinois.

Tenneco is an $8.6 billion global manufacturing company with headquarters in Lake Forest, Illinois and approximately 31,000 employees worldwide. Tenneco is one of the world’s largest designers, manufacturers and marketers of clean air and ride performance products and systems for automotive and commercial vehicle original equipment markets and the aftermarket. Tenneco’s principal brand names are Monroe®, Walker®, XNOx® and Clevite®Elastomers.

Revenue estimates in this release are based on OE manufacturers’ programs that have been formally awarded to the company; programs where Tenneco is highly confident that it will be awarded business based on informal customer indications consistent with past practices; and Tenneco’s status as supplier for the existing program and its relationship with the customer. These revenue estimates are also based on anticipated vehicle production levels and pricing, including precious metals pricing and the impact of material cost changes. Unless otherwise indicated, our revenue estimate methodology does not attempt to forecast currency fluctuations, and accordingly, reflects constant currency. For certain additional assumptions upon which these estimates are based, see the slides accompanying the May 1, 2017 webcast, which will be available on the financial section of the Tenneco website at www.investors.tenneco.com.

This press release contains forward-looking statements. Words such as “may,” “expects,” “anticipate,” “projects,” “will,” “outlook” and similar expressions identify forward-looking statements. These forward-looking statements are based on the current expectations of the company (including its subsidiaries). Because these forward-looking statements involve risks and uncertainties, the company's plans, actions and actual results could differ materially. Among the factors that could cause these plans, actions and results to differ materially from current expectations are:

(i) general economic, business and market conditions;

(ii) the company’s ability to source and procure needed materials, components and other products and services in accordance with customer demand and at competitive prices;

(iii) the cost and outcome of existing and any future claims, legal proceedings, or investigations, including, but not limited to, any of the foregoing arising in connection with the ongoing global antitrust investigation, product performance, product safety or intellectual property rights;

(iv) changes in capital availability or costs, including increases in the company's costs of borrowing (i.e., interest rate increases), the amount of the company's debt, the ability of the company to access capital markets at favorable rates, and the credit ratings of the company’s debt;

(v) changes in consumer demand, prices and the company’s ability to have our products included on top selling vehicles, including any shifts in consumer preferences to lower margin vehicles, for which we may or may not have supply arrangements;

(vi) changes in automotive and commercial vehicle manufacturers' production rates and their actual and forecasted requirements for the company's products such as the significant production cuts during recent years by automotive manufacturers in response to difficult economic conditions;

(vii) the overall highly competitive nature of the automobile and commercial vehicle parts industries, and any resultant inability to realize the sales represented by the company’s awarded book of business which is based on anticipated pricing and volumes over the life of the applicable program;

(viii) the loss of any of our large original equipment manufacturer (“OEM”) customers (on whom we depend for a substantial portion of our revenues), or the loss of market shares by these customers if we are unable to achieve increased sales to other OEMs or any change in customer demand due to delays in the adoption or enforcement of worldwide emissions regulations;

(ix) the company's continued success in cost reduction and cash management programs and its ability to execute restructuring and other cost reduction plans, including our current cost reduction initiatives, and to realize anticipated benefits from these plans;

(x) risk inherent in operating a multi-national company, including economic, exchange rate and political conditions in the countries where we operate or sell our products, adverse changes in trade agreements, tariffs, immigration policies, political stability, and tax and other laws, and potential disruption of production and/or supply;

(xi) workforce factors such as strikes or labor interruptions;

(xii) increases in the costs of raw materials, including the company’s ability to successfully reduce the impact of any such cost increases through materials substitutions, cost reduction initiatives, customer recovery and other methods;

(xiii) the negative impact of fuel price volatility on transportation and logistics costs, raw material costs, discretionary purchases of vehicles or aftermarket products, and demand for off-highway equipment;

(xiv) the cyclical nature of the global vehicular industry, including the performance of the global aftermarket sector and longer product lives of automobile parts;

(xv) product warranty costs;

(xvi) the failure or breach of our information technology systems and the consequences that such failure or breach may have to our business;

(xvii) the company's ability to develop and profitably commercialize new products and technologies, and the acceptance of such new products and technologies by the company's customers and the market;

(xviii) changes by the Financial Accounting Standards Board or other accounting regulatory bodies to authoritative generally accepted accounting principles or policies;

(xix) changes in accounting estimates and assumptions, including changes based on additional information;

(xx) the impact of the extensive, increasing and changing laws and regulations to which we are subject, including environmental laws and regulations, which may result in our incurrence of environmental liabilities in excess of the amount reserved;

(xxi) natural disasters, acts of war and/or terrorism and the impact of these occurrences or acts on economic, financial, industrial and social condition, including, without limitation, with respect to supply chains and customer demand in the countries where the company operates; and

(xxii) the timing and occurrence (or non-occurrence) of transactions and events which may be subject to circumstances beyond the control of the company and its subsidiaries.

The company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of this press release. Additional information regarding these risk factors and uncertainties is detailed from time to time in the company's SEC filings, including but not limited to its annual report on Form 10-K for the year ended December 31, 2016.

###

Investor inquiries:

Linae Golla

847-482-5162

lgolla@tenneco.com

Media inquiries:

Bill Dawson

847-482-5807

bdawson@tenneco.com